According to Amazon’s official fee structure, FBA fees typically cost sellers 15-25% of each sale, including fulfillment fees ($ 3-$20+), storage fees ($0.78-$ 2.40 per cubic foot), and referral fees (6-45% by category).

This complete guide reveals every fee type, calculation method, and optimization strategy to protect your profit margins.

You’ll discover how to use fee calculators, compare FBA versus FBM costs, and implement proven tactics to reduce expenses while maintaining competitive pricing in 2025’s stable fee environment.

What Are Amazon FBA Fees?

Amazon FBA fees are charges sellers pay for using Amazon’s fulfillment service. Amazon charges these fees to cover the costs of warehousing, order processing, shipping, and customer service.

The primary fee categories comprise fulfillment fees, storage fees, and referral fees, each serving distinct operational aspects of the Amazon marketplace.

Three FBA Fees All Amazon Sellers Must Pay

These three core fees form the foundation of Amazon’s FBA pricing structure and significantly impact your bottom-line calculations. Understanding each fee type helps you price products competitively while maintaining healthy profit margins.

Every Amazon seller using FBA must pay these core fees:

1. Fulfillment Fees: Charged per unit for the cost of picking, packing, and shipping orders to customers.

2. Storage Fees: Monthly charges based on the cubic footage your inventory occupies in Amazon warehouses.

3. Referral Fees: A Percentage of each sale is paid to Amazon for marketplace access and transaction processing.

These fees work together to create your total Amazon selling costs, making accurate calculations essential for profitable operations.

1. Amazon FBA Fulfillment Fees: Cost Per Unit Breakdown

Fulfillment fees represent the highest variable cost for most sellers, directly affecting per-unit profitability on every order processed through FBA.

Amazon categorizes products into standard-size and oversized classifications, with fees calculated based on weight and dimensional measurements. Recent seller data indicate that fulfillment costs have increased by an average of 12-18% for standard-size items and up to 24% for oversized products.

Peak season surcharges apply during high-demand periods, typically from October through January, adding extra costs during the busiest selling months.

| Product Size | Weight Range | Fulfillment Fee Range |

|---|---|---|

| Small Standard | 0.5 oz – 1 lb | $3.22 – $4.75 |

| Large Standard | 1+ lb – 20 lb | $4.75 – $18.30 |

| Large Standard | 20+ lb – 70 lb | $18.30 – $89.98 |

| Oversize | 70+ lb – 150 lb | $89.98 – $195.50 |

This pricing structure rewards sellers who optimize packaging and product dimensions, as smaller, lighter items cost significantly less to fulfill than bulky alternatives.

2. Amazon FBA Storage Fees: Monthly Cost And Calculations

Storage fees accumulate monthly and can quickly impact profitability if inventory levels aren’t managed properly, especially during peak season pricing periods.

The 2025 storage fee for standard-size products is $0.78 per cubic foot per month during the off-peak season (January to September).

Peak season rates from October through December nearly double these costs, encouraging sellers to maintain leaner inventory during high-demand periods. Long-term storage fees apply to items stored longer than 365 days, adding substantial costs for slow-moving inventory.

| Product Size | Off-Peak (Jan-Sep) | Peak (Oct-Dec) |

|---|---|---|

| Standard-size | $0.78 per cubic foot | $2.40 per cubic foot |

| Oversize | $0.78 per cubic foot | $2.40 per cubic foot |

The significant peak season increase motivates sellers to carefully time their inventory shipments, avoiding excess stock during the most expensive storage months.

3. Amazon Referral Fees: How Much Amazon Takes From Each Sale

Referral fees represent Amazon’s commission for providing marketplace access, payment processing, and customer acquisition services to sellers.

- Category-Based Percentage Structure: Referral fees vary by product category, ranging from 5% to 45%, with most categories falling between 8% and 15% of the total sale price, including shipping and gift wrapping.

- Media Item Flat Fees: Books, music, and video products pay flat fees ranging from $1.35 to $1.80 per item instead of percentage-based rates.

- Minimum Fee Protection: Amazon charges a minimum referral fee of $0.30 per item, protecting sellers of very low-priced products from excessive percentage costs.

- Variable Closing Fees: Certain media categories include additional variable closing fees based on format and product type.

These fees directly reduce your profit margin on each sale, making category selection crucial for maintaining healthy business economics.

Individual Per-Item Fees Or Subscription Fees

Amazon offers two selling plans that affect your fee structure and available selling tools.

| Plan Type | Cost Structure | Best For |

|---|---|---|

| Individual | $0.99 per item sold | Sellers with fewer than 40 monthly sales |

| Professional | $39.99 monthly subscription | High-volume sellers needing advanced tools |

Professional sellers save money when selling more than 40 items monthly while gaining access to bulk listing tools, advertising options, and detailed analytics. Understanding these fee structures helps sellers make informed decisions about their business model and potential earnings as Amazon FBA sellers.

How To Calculate Amazon Fees?

Accurate fee calculation prevents pricing mistakes and ensures profitable product launches across all your Amazon listings.

Step 1: Access Amazon’s FBA Revenue Calculator

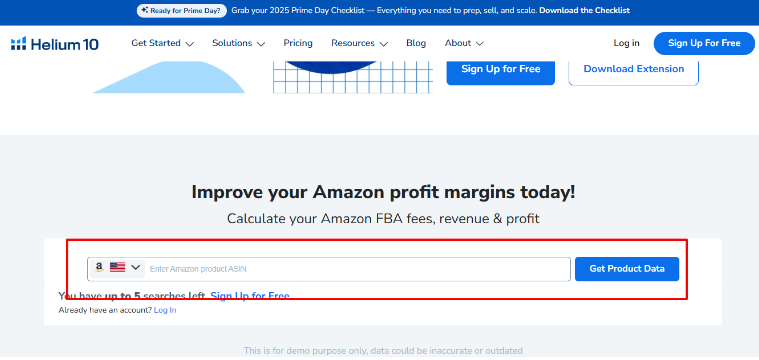

Visit sellercentral.amazon.com and search for “Revenue Calculator,” or use free third-party tools, such as Helium 10’s calculator, for enhanced features and real-time analysis.

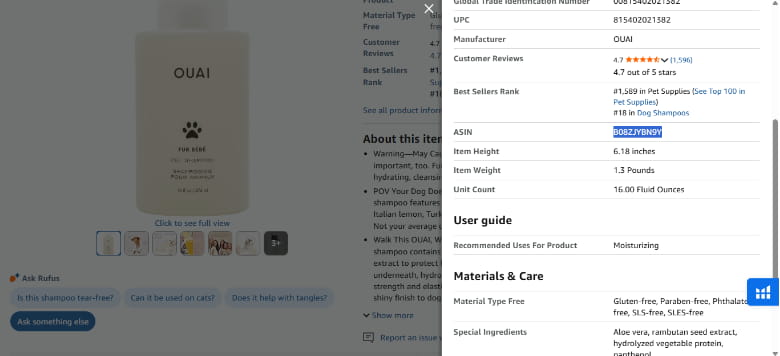

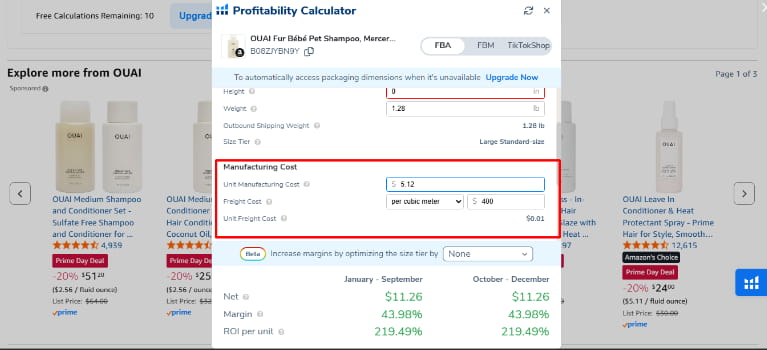

Step 2: Enter Product Details

Input your product’s ASIN if it exists, or manually enter dimensions (length, width, height), weight, and your intended selling price for accurate calculations.

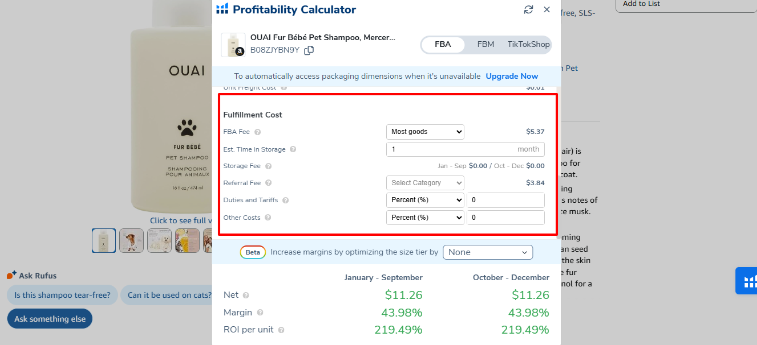

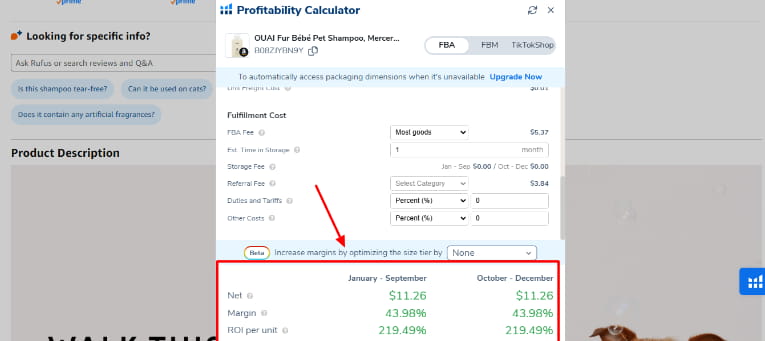

Step 3: Review Automated Fee Calculations

The calculator automatically displays fulfillment fees, storage costs, and referral fees based on your product specifications and current Amazon rates.

Step 4: Add Your Product Costs

Enter your product cost, shipping to Amazon, and any prep costs to see your actual profit margin per unit sold.

Step 5: Analyze Total Profitability

Review the net profit calculation and adjust your selling price or product specifications to optimize your margins before listing your product.

These calculations help you set competitive prices while maintaining target profit margins across your entire product catalog. For sellers seeking better data accuracy, understanding tool limitations and cross-referencing multiple calculators ensures more reliable profit projections.

Additional Amazon FBA Fees You Need To Know

Beyond core fees, Amazon charges various operational and service fees that can impact your overall profitability calculations.

1. Core Fees: These include fulfillment, storage, and referral fees that form the base cost structure for all FBA sellers.

2. Processing Fees: Return processing fees apply when customers return items, while inbound placement service fees help optimize your inventory distribution across warehouses.

3. Operational Fees: Removal fees apply when you retrieve inventory from warehouses, disposal fees cover destroying unsellable items, and unplanned service fees are charged for non-compliant shipments.

4. Volume-Based Fees: High-volume listing fees apply to sellers with extensive catalogs, while aged inventory surcharges penalize long-term storage that exceeds standard limits.

5. Service Fees: Multi-channel fulfillment lets you use FBA for non-Amazon orders, while inventory placement service fees control where Amazon stores your products.

6. Prep Service Fees: Amazon charges for labeling, polybagging, bubble wrapping, taping, shrink wrapping, suffocation warnings, and FNSKU label application when you don’t prep items yourself.

Understanding these additional costs helps you budget accurately and avoid unexpected charges that could impact your profit margins.

Amazon FBA vs FBM: Cost Comparison Analysis

Choosing between FBA and FBM depends on your volume, resources, and profit margins across different product categories.

| Factor | FBA | FBM |

|---|---|---|

| Per-Unit Costs | $4-20+ fulfillment fees | $3-15 shipping costs |

| Storage Costs | $0.78-2.40 per cubic foot | Warehouse rent/space |

| Time Investment | Minimal daily management | 2-4 hours per day |

| Prime Eligibility | Automatic inclusion | Must qualify separately |

| Customer Service | Amazon handles returns | You handle all issues |

| Scalability | Easy to scale up/down | Requires infrastructure |

Verdict: FBA is the better choice for most sellers due to Prime eligibility, time savings, and scalability unless you’re selling heavy, low-margin items where FBM’s cost advantages outweigh operational complexity.

This analysis helps you choose the most profitable fulfillment method for each product in your catalog. Sellers who want to explore FBA versus FBM can dive deeper into specific scenarios where merchant fulfillment might provide better returns.

Strategies To Reduce Your Amazon FBA Fees

Smart sellers employ targeted strategies to minimize fees while maintaining high service quality and customer satisfaction.

- Inventory Management: Maintain a 60-90 day stock level to avoid long-term storage fees while preventing stockouts.

- Packaging Optimization: Reduce dimensions and weight through better packaging design to lower fulfillment costs.

- Shipment Timing: Send inventory during off-peak months to avoid higher storage rates.

- Category Selection: Focus on categories with lower referral fees and higher profit margins.

- Bulk Shipping: Consolidate shipments to reduce per-unit inbound costs and improve efficiency.

These strategies can significantly reduce your overall Amazon fees while improving operational efficiency across your business. Many sellers also benefit from learning whether Amazon FBA is worth it before implementing costly optimization tactics.

Related Reads:

Conclusion: Mastering Amazon FBA Fees for Profitable Growth!

FBA fees will cost you 15-25% of each sale through fulfillment, storage, and referral charges, but innovative fee management can significantly improve your bottom line.

The key takeaways include using Amazon’s calculator for accurate pricing, optimizing inventory timing to avoid peak storage rates, and focusing on lightweight products with healthy margins.

Start implementing these strategies today to reduce your fee burden and build a more profitable Amazon business.

FAQs

Amazon typically takes 15-25% of a $100 sale, including 8-15% referral fees plus $4-8 in fulfillment fees, depending on product category and size.

Professional sellers pay $39.99 monthly, while individual sellers pay $0.99 per item sold, making the subscription worthwhile for 40 or more monthly sales.

FBA fees cover warehousing, order processing, shipping, customer service, and Prime eligibility, providing comprehensive fulfillment infrastructure that individual sellers couldn’t replicate cost-effectively.

Amazon typically updates its fees annually, although it announced no fee increases for 2025, providing sellers with cost stability after multiple changes in 2024.

Amazon’s fees are non-negotiable for individual sellers, though high-volume sellers may qualify for special programs with reduced rates through invitation-only arrangements.